Embrace all your

possibilities!

Business Solutions Group, LLC

Building a business and acquiring wealth takes vision, ambition, skill, and determination.

We want you to grow your wealth with a level of skill and attention. We want you to accomplishBullet list

Lifetime objectives

Reach your personal, family and business goals, while creating your legacy.

financial balance

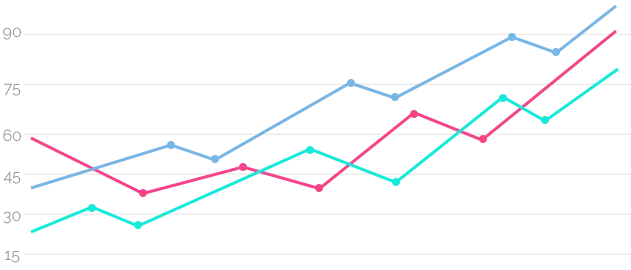

BSG guides your team for positive results

Monthly Growth

Services

CFO Virtual

Business Solutions Group, LLC (BSG) provides Virtual CFO Services. We provide support and expertise for your businesses especially now when the world is constantly changing.

Tax PLanning

Business Solutions Group, LLC ( BSG) Tax division offers all forms of accounting and regulatory compliance services.

Financial Consulting

Business Solutions Group, LLC (BSG) works with businesses, individuals, and other entities to provide guidance for starting a new business.

Financial Planning

Business Solutions Group, LLC (BSG) Financial Wealth group is focused on your total financial wellness. Our professionals work together to unlock strategies aimed at enhancing your financial well-being.

Our Clients

Business owners choose BSG for our practical, industry-focused insights.

Our mission is to help your organization become more successful.

leave your number below, we'll contact you shortly

Our Blogs

The next 14 days are key for an exceptional 2021

February 19, 2021

Possibilities & Probabilities

December 24, 2020

The Financial Process

December 11, 2020

Financial Well being for everyone

November 11, 2020

Failing to Plan is Planning for Failure, By Benjamin Franklin

November 11, 2020

Speech Crazy Imagined World

October 12, 2018

Register for our newsletter to be informed about the latest developments and events.

Our ultimate goal is to create peace of mind for business owners and entrepreneurs. We do this by ensuring that your business not only remain profitable but also sustainable in the long term.